Wealth Tracker For Mac

I received an email recently from a frustrated investor. He had been investing in a Roth IRA for several years. The broker he was using reported his total return at about 30%.

He knew the performance metric was dead wrong. If you’ve tried to calculate your investment returns then you know just how maddening it can be. Monthly contributions, reinvested dividends, and rebalancing make determining your performance more complicated than a Rube Goldberg machine. There are several free tools that can help. From calculating investment performance to keeping an eye on fees and, here are 5 of the best tools to track your investments.

Personal Capital My personal favorite and the tool I use daily. Enables an investor to link virtually any investment account, including retirement and taxable accounts. Once linked, Personal Capital tracks performance, asset allocation, and fees. Graphs make it easy to compare returns to an index or understand a portfolio’s asset allocation, as in the screenshot below: Personal Capital also offers a 401k Fee Analyzer. This tool calculates the fees paid in a 401k and the effects of those fees over your investing time horizon. Personal Capital offers free apps for smartphone and tablets.

Morningstar offers one of the most robust investment tracking tools available today. After you’ve entered your portfolio, Morningstar makes its industry leading tools available to evaluate the investments. These tools include the basics, such as performance, investment costs, and comparison to various indexes. Morningstar also makes available more advanced tools, such as its star ratings and X-Ray feature. The X-Ray tool enables an investor to see details of a portfolio of mutual funds.

For example, the tool reveals a portfolio’s asset allocation, style box rating, stock sectors, industry sectors, and geographic exposure. The major drawback to Morningstar is that it cannot link to your investment accounts, so portfolios must be entered manually. The portfolio tool is available with a free membership, although some tools require a premium membership.

Budgeting Software Budgeting tools may seem like an odd way to track investments. Yet several tools designed to track your spending can also keep an eye on your investments. Perhaps the most popular budgeting tool that doubles as a portfolio tracker is. Owned by Intuit, the makers of Quicken and TurboTax, Mint is an online tool that enables you to link bank accounts, credit cards, and investment accounts in one place. Once linked, Mint tracks your investment performance.

It also tracks investing fees. Mint, which is free, is an ideal tool for those that want to track their spending and investments in one place. It does not, however, offer the variety of investment tools you’ll find with Personal Capital or Morningstar. Google Finance Google Finance offers a free. What it lacks in the bells and whistles department, it makes up for with simplicity. Portfolios can be entered manually or uploaded in several formats.

Once entered, Google tracks daily and overall performance. The portfolio tracker offers information about the fundamentals of the investments. It is also integrated into Google News. Below the portfolio is a listing of current news items related to the companies tracked in the portfolio. A portfolio can be downloaded to a spreadsheet or any one of several proprietary formats. Finally, Google Finance provides a performance chart.

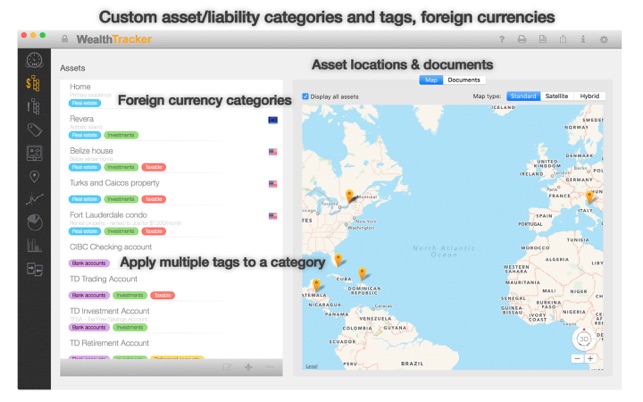

Personal Wealth Tracker

The chart can be set to review performance for the past few months or the last 10 years. You can easily compare your portfolio’s performance to a major index with just the click of a mouse. SigFig The last tool in our lineup is a newcomer. Is an online tool that will link to investment accounts at most financial institutions. With SigFig it is easy to track the performance of a portfolio.

In addition, SigFig offers a number of tools to analyze a portfolio. It evaluates asset allocation, risk, fees, dividends and yield, and geographic allocation. It also displays this information in helpful charts and graphs.

SigFig is free and also offers a tool to evaluate the asset allocation of a portfolio. Rob Berger founded, a personal finance website, a credit card and banking website, and, a free weekly newsletter. RECOMMENDED BY FORBES.